Live now, pay later™

with the FlexitiCard®

Get instantly approved¹ for no interest financing*

We’ve partnered with Flexiti to help turn your big purchases into small payments.

Apply today and get approved for no interest financing*

in minutes.¹

How it works

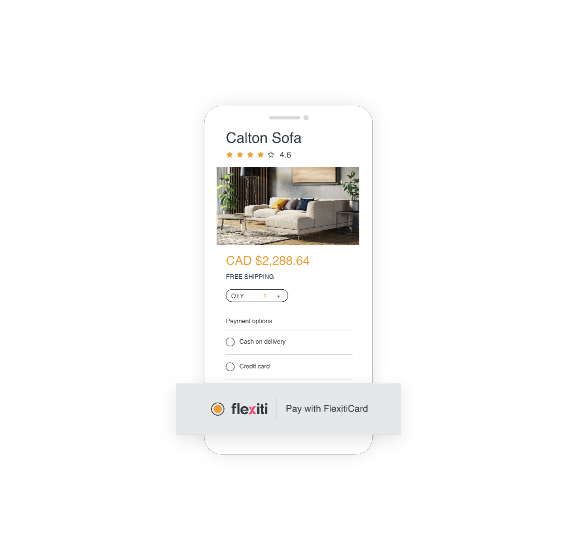

Choose Flexiti at checkout or talk to a sales representative in-store to apply and instantly finance your purchase.¹

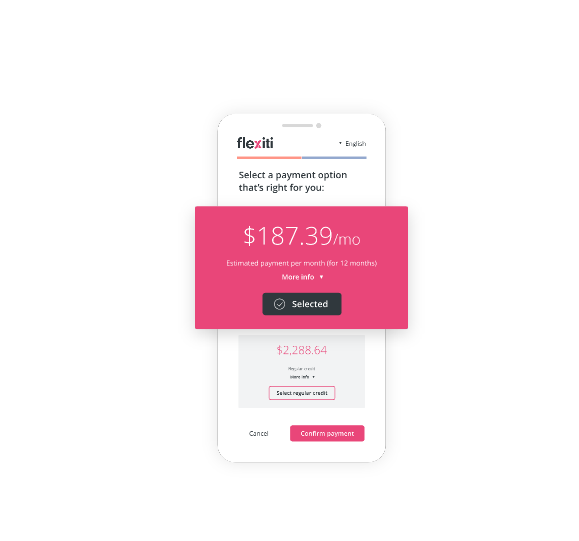

We know it’s good to have options. You can pick the financing plan and term that suits your budget.

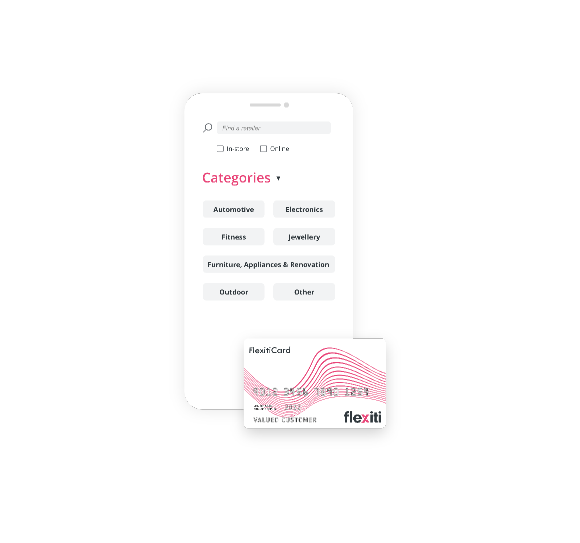

You can use your FlexitiCard again and again, without reapplying! It is accepted at thousands of retail locations within the

Flexiti Network™.

^ Screen images simulated

The flexible way to pay™

Plans that work for you

Flexiti fees

Admin fee

A $39.99 annual fee ($24.99 for residents outside of Quebec), if applicable, is charged on your monthly statement following your first transaction and, if there is an outstanding balance on your account, on each anniversary date of your first purchase transaction.

Admin fee (not applicable for Quebec residents)

A transactional fee that’s charged when you finance a purchase. Admin fees range from

$59.99 – $159.95

depending on your term length and may be expressed as a monthly or annual amount. Admin fees are financed within your total purchase amount.

The Flexiti Network

The FlexitiCard is accepted at thousands of Canadian retail locations, in-store and online! Shop for electronics, furniture, appliances, jewellery, fitness equipment, auto parts and more.

Introducing the Flexiti Wave CardTM!

While not all Flexiti cardholders are eligible for no interest financing plans, Flexiti offers alternative financing options with the Flexiti Wave Card.

Flexiti Simply Secure™

Did you know? Simply Secure is an insurance program that offers payment protection coverage to Flexiti cardholders in case of certain unforeseen circumstances.

Learn more about Flexiti Simply Secure™ on www.flexiti.com.

FAQs

Got a question? We’re here to help.

The flexible way to pay™

*O.A.C. On your FlexitiCard. Minimum product purchase of $XXX (excluding/including taxes) is required. No interest equal monthly payment plans: no interest will accrue during the promo period. Purchase amount is to be paid in equal monthly payments plus payment protection insurance premiums and taxes, if applicable. If any payment is missed, all promo offers on the account may be cancelled and upon cancellation, interest will be calculated at the cardholder agreement annual interest rate (Account AIR). Interest bearing equal monthly payment plans: the annual promotional interest rate for the promo term will be disclosed prior to completion of the transaction. Purchase amount is to be paid in equal monthly payments of principal and interest, plus payment protection insurance premiums and taxes, if applicable. If any payment is missed, all promo offers on the account may be cancelled and upon cancellation, interest will be calculated at the Account AIR. No payment deferred plans are not available for Quebec residents. Minimum monthly payment deferred plans: the greater of 5% of the outstanding balance (excluding equal monthly payments) plus payment protection insurance premiums and taxes, if applicable, or $10, is due each month. Interest at the Account AIR accrues during the promo period and will be charged if the balance is not paid in full by the promo expiry date or if the promo is cancelled due to payment default on the account. Regular Credit Purchases: An interest-free grace period of 21 days applies for new standard revolving purchases that appear on your account statement for the first time if the balance is paid in full by the payment due date. The minimum payment is the sum of interest, payment protection insurance premiums and taxes, if applicable, plus $10. Initial Account AIR is disclosed upon approval, varies based on cardholder’s creditworthiness at time of application. Current Account AIRs are 31.99% - 39.99% (35% max for Quebec residents). Any balance at end of promo term bears interest at the Account AIR. Promos and terms may be changed without notice. Eligibility for promotions varies with cardholder creditworthiness.

**O.A.C. Available at select merchants. Subject to terms of the Flexiti cardholder agreement. Minimum purchase may apply. Promo periods between 24 to 60 months may be available, depending on the merchant. Purchase amount will be charged to your account in equal monthly payments of principal and interest at promo annual interest rate of 19.99% or 29.99% (promo annual interest rate depends on cardholder creditworthiness and will be advised prior to purchase), plus payment protection insurance premiums, fees and taxes, if applicable. If any payment is missed, all promo offers on the account may be cancelled and upon cancellation, interest will be calculated at the account annual interest rate (“Account AIR”). Any balance at the end of the promo period bears interest at the Account AIR. Account AIR is 39.99% (35% for Quebec residents) or as advised upon account approval and on your monthly statement. Monthly admin fee applies; amount varies based on merchant, purchase amount and promo term length and will be financed with purchase (not applicable for Quebec residents). Annual fee of $99.99 applies for residents of Quebec and $24.99 may apply for residents of other provinces. Promos and terms may be changed without notice.

1Conditional upon ID verification and on approved credit and valid email address required. Applications may be subject to a secondary, manual review.

Financing provided by Flexiti Financial. B.C. Licence No. 83660. Flexiti, FlexitiCard, Flexiti Wave Card, flexible way to pay, Simply Secure, live now, pay later, Flexiti Network and the Flexiti design are trademarks of Flexiti Financial Inc.